According to the latest Treasury data released today, in November – the second month of fiscal 2025 – the US spent a massive $584.2 billion, a 14% increase from the prior year, and a record for the month of November.

For those who remember out outrage from a month ago, will also remember that the latest deficit number follows what was also a record government outlay for the month of October.

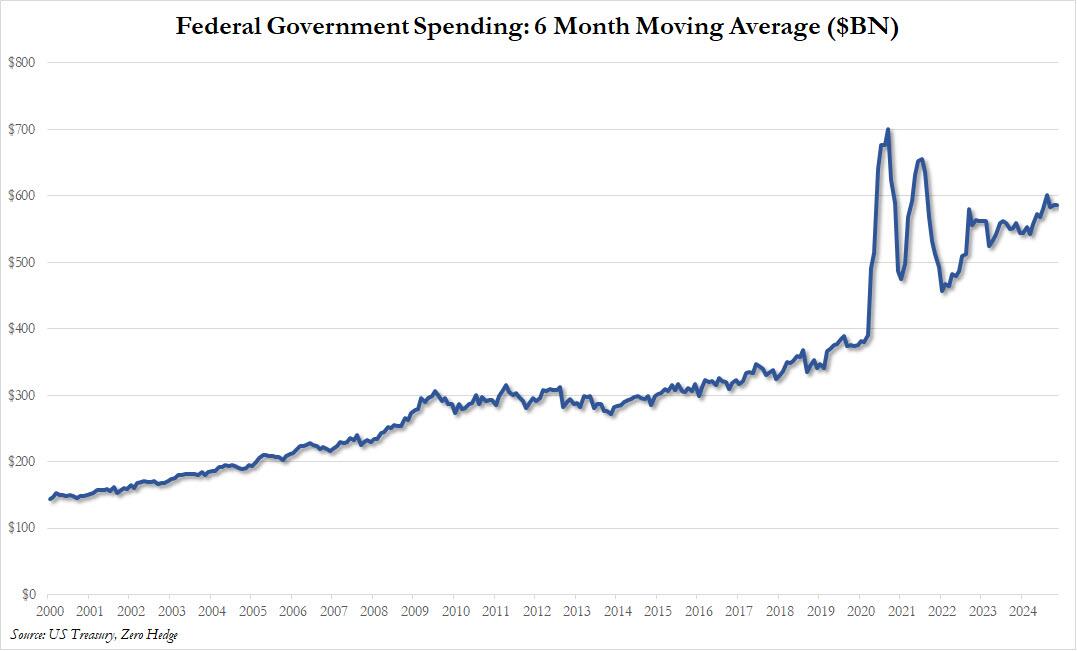

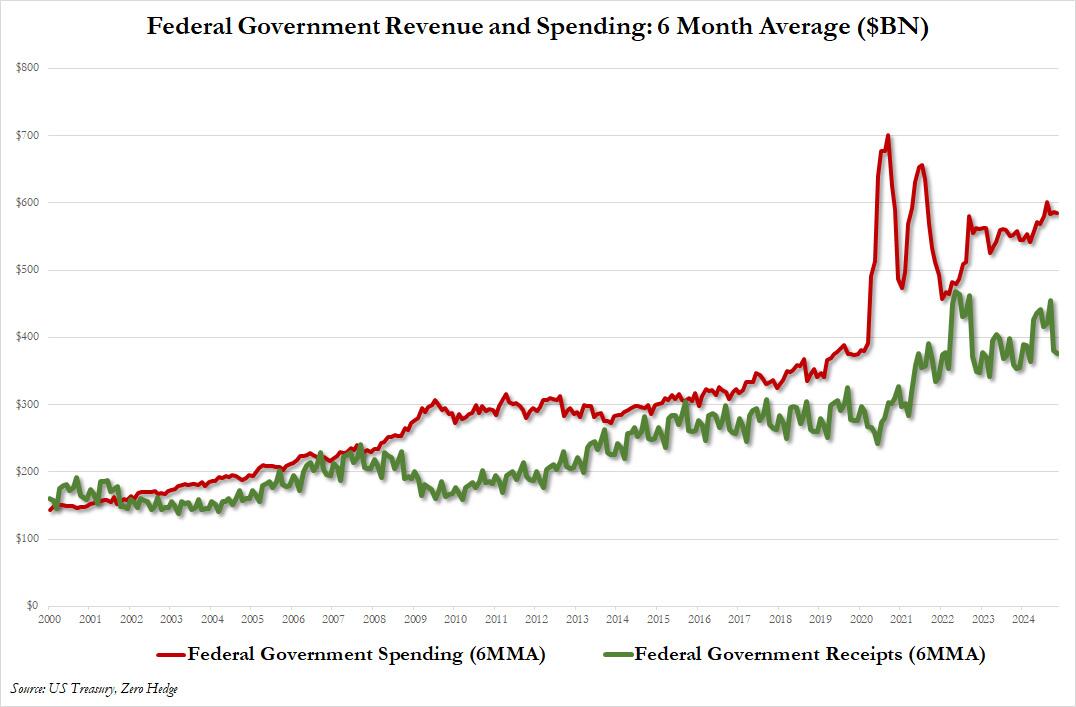

US government spending shock: On a trailing 6 month moving average basis, to smooth out outliers months, the spending hit $586 billion, effectively at an all time high with just the record spending spree during covid pushing government spending higher, writes Zerohedge.

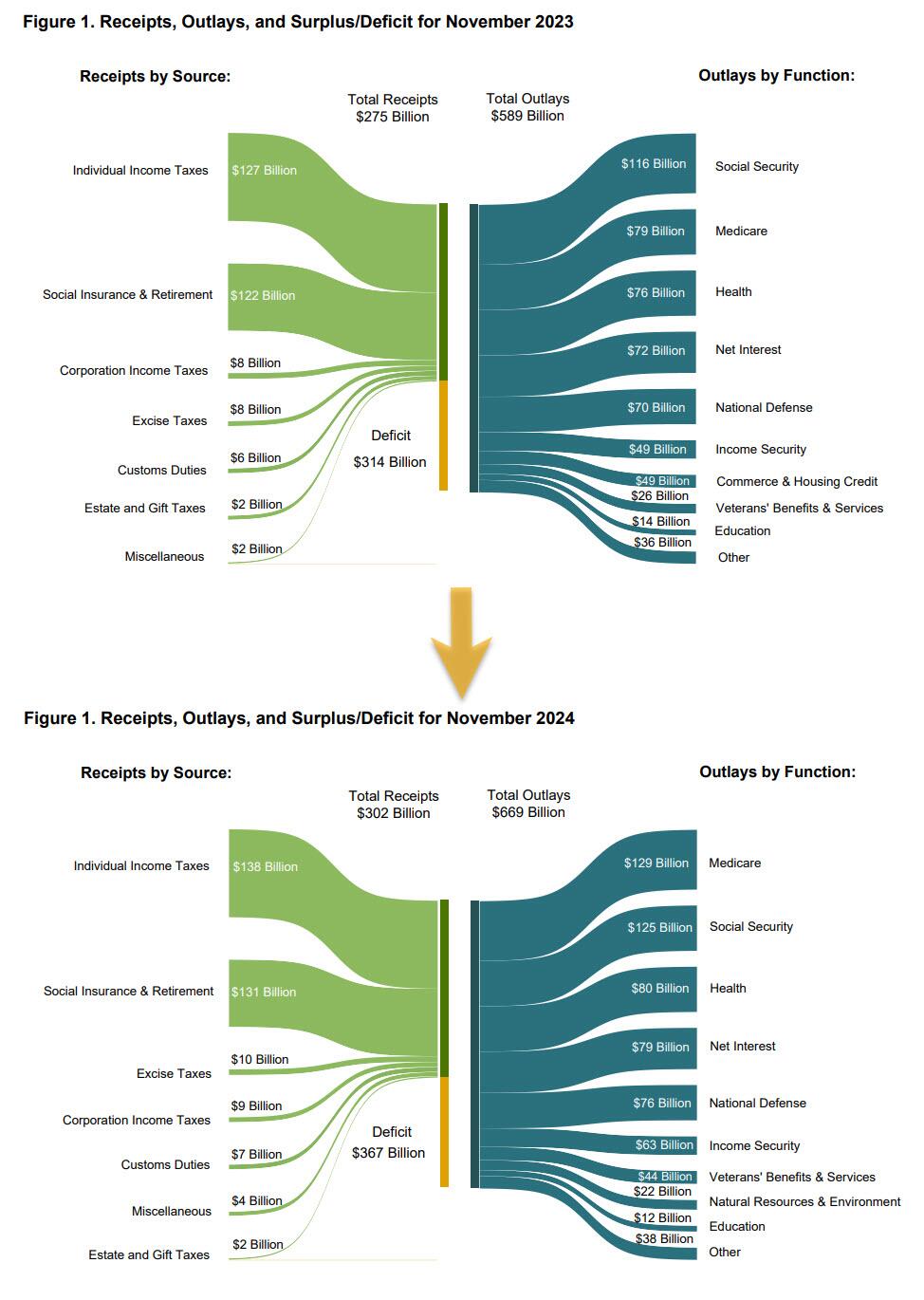

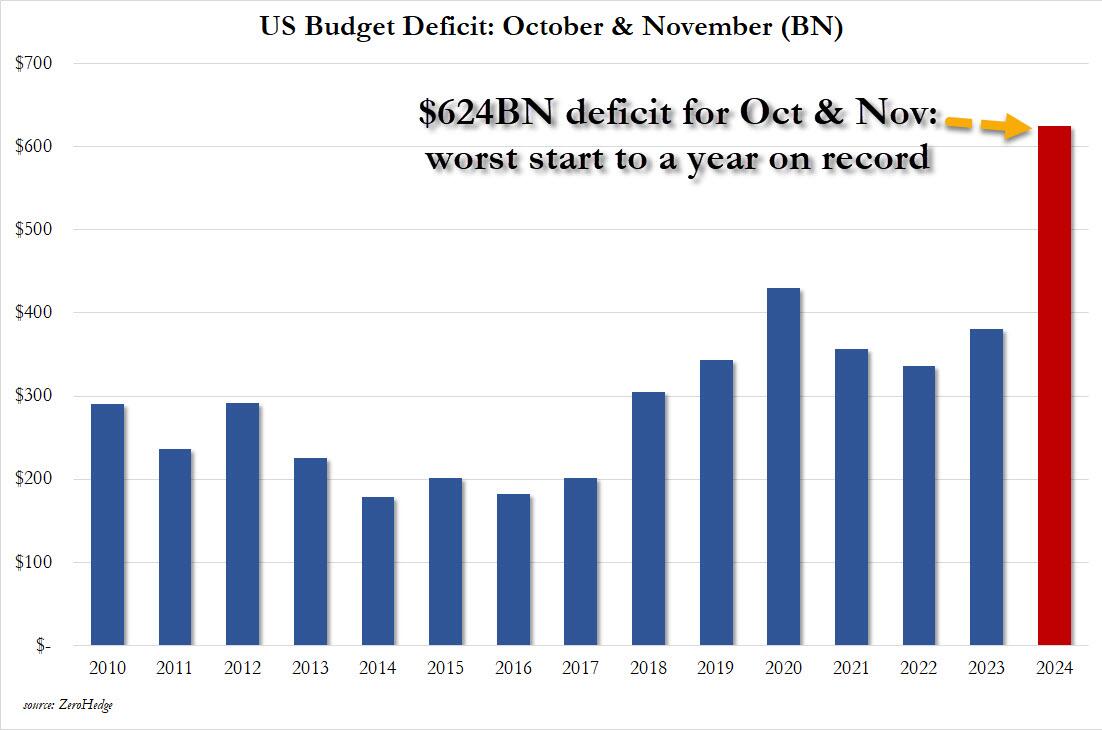

It shows that in October and November, the US deficit exploded to a staggering $624.2 billion, and even though this included several calendar adjustments – which explains the freak September surplus which as we said was due to calendar effects – the November deficit of $367 billion was $14 billion more than consensus estimates of $353 billion.

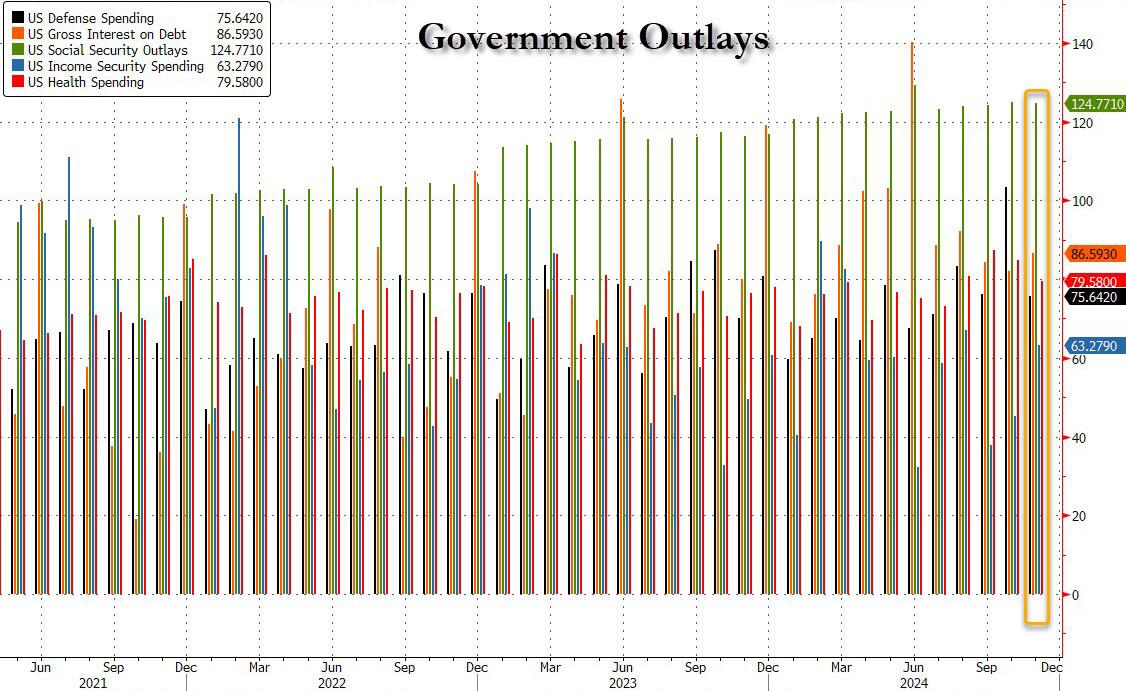

The surge in spending was driven primarily by higher spending on health, defense and Social Security, but mostly a huge $50BN spike on Medicare outlays!

RELATED ARTICLES:

- Corporatist Fascism: How the Left and the Right joined forces to kill Democracy and empower the Billionaire class

- Marxism infused DEI programs demonize the majority population – creating discrimination, hostility and division

- The Federal Reserve Cartel – Read about the Eight Families that own the USA

- Marxist “Inclusion” (DEI) produce discrimination, woke hostility and division

- Number 1 Bestseller on Amazon: The Billionaire World: How the Globalist Trade System causes Wealth to remain with the Top Elite

US government spending shock: The long-term chart of government spending shows what we all know: DOGE or not DOGE, there is no stopping this train.

The surge in spending was far greater than the much more modest increase in tax revenues: in November, the US government collected $301.8 billion in taxes, up 9.8% from the $274.8 billion last November.

As shown in the next chart, while spending continued to grow exponentially, tax receipts have flatlined, and the 6 month average in October was just $380 billion, the same as three years ago!

US government spending shock: To be sure, there were some calendar effects in play. Recall that last month we said that October 2023’s tax receipts were unusually higher due to deferred tax receipts that were received that month from companies and individuals affected by disasters including wildfires in California.

Taking that into account, the October budget deficit would have been 22% higher (and would offset the freak September surplus which we are convinced was staged to make the last month of fiscal 2024 look abnormally good for the Biden admin).

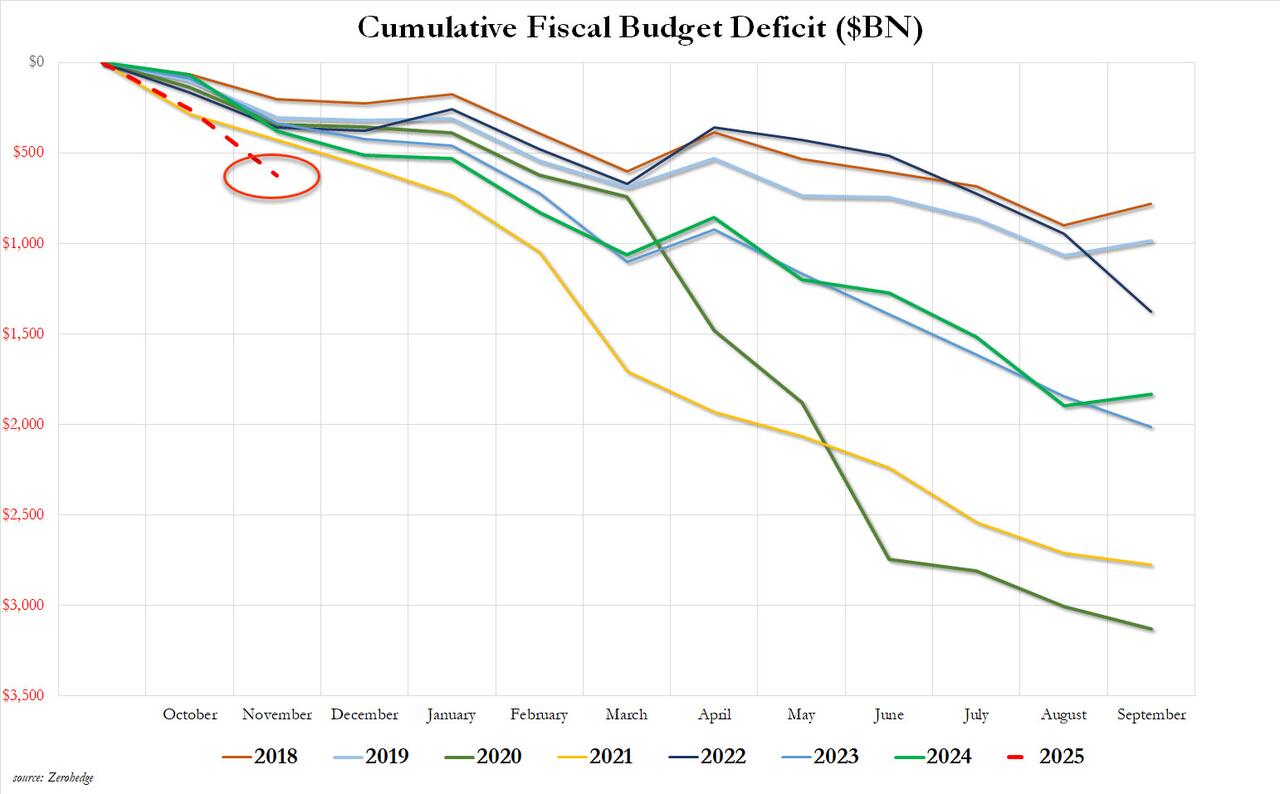

And since some of this calendar effect also nets in November, to avoid the calendar shifts across months we combined the first two months of fiscal 2025.

What we got was this shocker of a chart:

US government spending shock: It shows that in October and November, the US deficit exploded to a staggering $624.2 billion, and even though this included several calendar adjustments – which explains the freak September surplus which as we said was due to calendar effects – the November deficit of $367 billion was $14 billion more than consensus estimates of $353 billion.

Worse, combining October and November we find that not only was the combined number of $624 billion some 64% higher than the corresponding period one year ago, but it was also the highest deficit on record for the first two-months of the year (and that includes the spending insanity during the covid crisis).

Putting the deficit in context, the budget deficit in October and November – the first two months of fiscal 2025 – are now officially the worst start a year for the US Treasury on record.

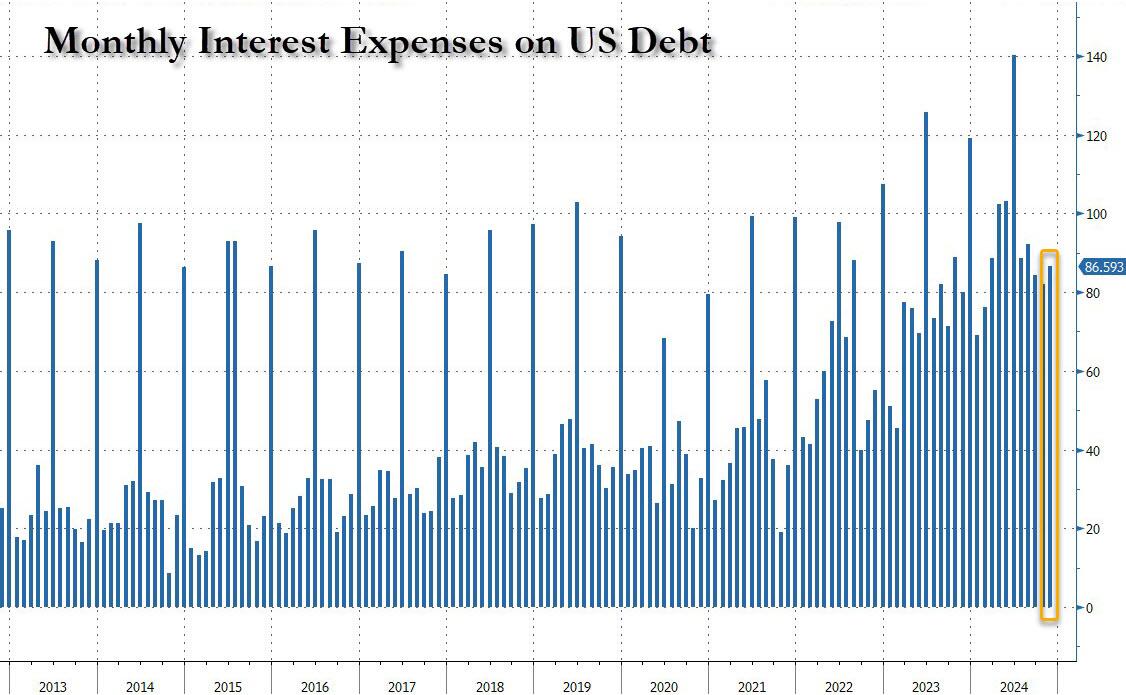

Taking a closer look at what has been the most terrifying trend in the US income statement for some time now, the Treasury’s debt-servicing costs rose once again in November. Gross interest costs totaled $87 billion, up $7 billion from $80 billion in the same month a year before.